The recent failures of Signature Bank and Silicon Valley Bank have left many individuals scrambling to check if their funds are secure. These failures were the second and third largest bank failures in US history, following the failure of Washington Mutual during the financial crisis of 2008. But why did these banks fail, and what happens to the money that was deposited in them? And just how much of your money is “safe” in your own bank account?

What Causes Banks to Fail?

Fans of the 1940s film It’s a Wonderful Life will remember the scene when all of the customers at the bank try and withdraw their funds at the same time. This is known as a “run on the bank,” and can cause the bank to fail if it cannot meet all the withdrawal requests of its customers, forcing it to begin selling its own assets. That is exactly what happened to Silicon Valley Bank and Signature Bank.

Silicon Valley Bank (SVB) was best known as the premier bank for technological startups, providing banking services to very high net worth companies and individuals. However, the past year has been financially difficult for the technological industry, requiring most of SVB’s customers to withdraw more and more funds in order to meet expenses such as payroll, product development, and other office costs. In order to meet that demand, SVB had to sell billions of dollars’ worth of investments that had lost value due to the Federal Reserve’s plan to increase interest rates. The combination of selling these investments at a loss while meeting its customers’ withdrawal requests caused regulators to seize SVB’s assets and the bank to fail on Friday, March 10, 2023. Just two days later, Signature Bank also failed after another run on the bank where customers withdrew over $10 billion in deposits, prompted by fear over SVB’s failure.

So what happens now for SVB’s and Signature’s customers?

Scrambling for Savings

The failures of SVB and Signature are devastating blows for their customers, many of which had much more than $250,000 deposited into their accounts. This is important because the FDIC only insures accounts for up to $250,000, and anything over that is considered uninsured. For example, digital media tech company Roku, Inc. had approximately $487 million deposited in SVB – an amount significantly higher than the insured limit! So what happens to all that money – is it simply lost?

Ordinarily, any uninsured amount wouldn’t be able to be recovered. However, in the case of Signature and SVB’s customers, the Federal Reserve has initiated a “bridge” bank to allow customers to continue to access their accounts, and any amount over the uninsured limit will likely be released so customers can access it. This is an attempt to lessen the effect of the bank failures and prevent a larger systematic risk.

Is Your Money Safe?

With two large banks failing so quickly and in rapid succession, many are wondering if even more banks will fail, and whether or not their money is safe.

Industry experts do not think the failures will spread, as SVB and Signature both were unique cases in that they were highly exclusive in the industries they served. Most other banks are diversified and don’t rely heavily on specific industries.

That being said, the FDIC insurance limit applies to everyone, and if you have more than that in your bank account, the excess amount is considered uninsured. This is a risk, and it may be a wise idea to take steps and ensure you have insurance for all of your funds.

Banking on Success

If you currently work with just one bank, you’re putting all of your eggs in one basket, so to speak. Your funds may be insured for up to the FDIC limit, but what happens if you wake up one morning and find out that your bank failed? What are you going to do until you can actually access your money?

Working with a second FDIC-insured bank not only helps to insure more of your wealth, but also gives you a way to access funds immedietly in the event that your primary bank fails.

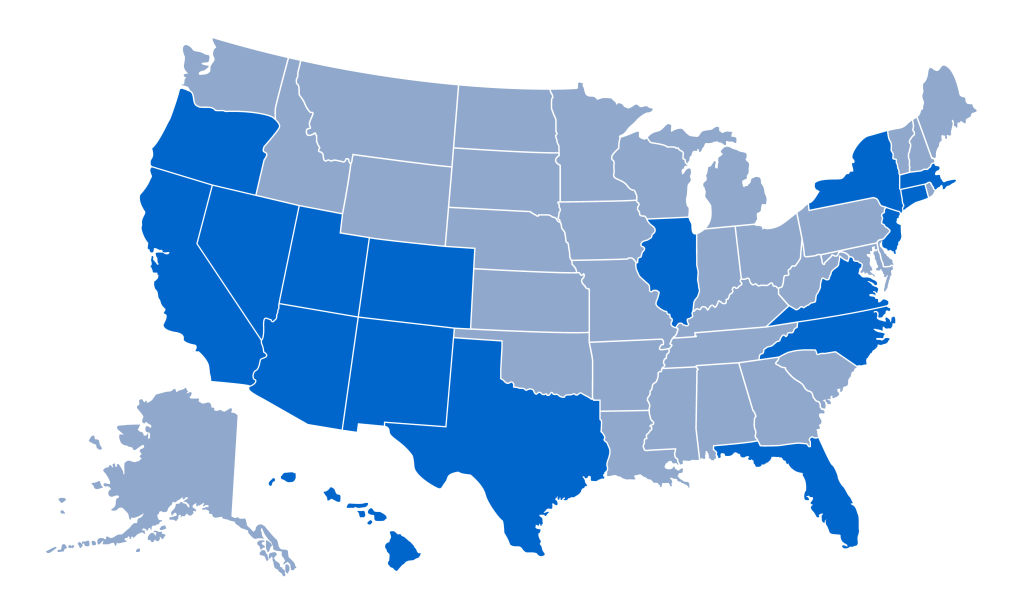

There can also be other benefits to banking with multiple banks, such as taking advantage of promotions, special interest rates, and rewards. We suggest having at least one account with a national bank and one account with a local or regional bank. National banks often can provide a greater range of services, while local banks are more connected to their communities. Both can offer great incentives for banking with them.

To get started comparing bank accounts, start browsing banks in your area.

Protect Your Wealth

There are a few key steps you can take to protect your money and ensure it’s insured. The easiest method is to work with at least two FDIC insured banks and split your funds between them. Finding another FDIC insured bank and opening an account them will allow you to have the funds in both banks insured, providing that both amounts are less than $250,000. Having accounts with multiple banks will also allow you to access at least some of your funds immedietly in the event of a bank failure, without you having to wait for regulators to remediate the situation.

Another potential option is to add a joint owner to your account, as joint accounts can be insured for a higher limit. Of course, this option only works if it makes sense for other reasons to add a joint owner, such as a spouse or a business partner.

Finally, many banks are a part of the IntraFi Deposits Network, which stores funds in excess of the FDIC limit with other banks that are a part of the same network, providing access to millions of FDIC insurance. This way, the entirety of your funds within the network are insured, but you only have to deal with one bank. You only get statements from one bank, and you get the interest rates and perks of working with that bank.

So which choice is right for you? Here are some ways for you to research your options.

Find Banking Options that are Right for You

Here are some ways to research how to protect your wealth:

1. Consult a Financial Advisor. Financial advisors can give you insight on how to invest, budget, and save wisely. They can also advise you on how to store your funds so that they are secure. Most financial advisors are more affordable than people think, and can provide suggestions and resources that can be worth more than their actual fee. You can compare vetted financial advisors here and contact your top choices for a free evaluation!

2. Compare Bank Accounts. If you currently only work with one bank, you should consider getting a second FDIC insured bank account. Keeping all of your funds with any one bank account could mean that some of your wealth will not be insured, and may make it more difficult to access your funds in the event of a bank failure. With RateZip, you can easily compare savings accounts and find one that’s right for you! CDs are another great option if you’re looking for a higher APY.

3. Speak with Your Bank. If you’re worried about your funds, want more information about FDIC insurance, or need more details about the security of your account, contact your current bank. Learn more about your bank’s financial health and review any product offerings they may have. You can also ask if your current bank is part of the IntraFi Deposits Network.

4. Stay Up to Date with Banking News. Finally, stay up to date with current banking news and events. Learning more about current events helps you stay with banking and financial trends. You can learn more about various financial topics right here on RateZip!